According to the recent ETNO-IDATE report, the telecom services market in Europe (EU-28) is stabilising, and even enjoying a slight uptick in Europe as a whole. Whereas the North American market has been enjoying steady growth over the past decade and Europe has been on a downwards slide, the situation has flipped – with market growth on the other side of the pond hovering around 0%, combining a close to 1% decrease in the mobile market during the first three quarters and very slight growth in the fixed market thanks to cable companies.

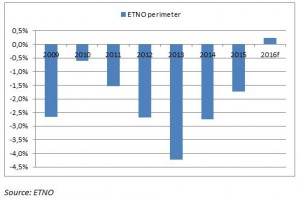

Annual telecom services revenue growth (ETNO, % )

In this rather sombre situation in Western markets, despite the remarkable success with 4G customers, monetising mobile access appears to be wavering between two main options.

– After an initial period where unmetered plans became the norm, using the argument of network congestion operators began selling plans that were tiered based on data caps. The common practice was to encourage customers who were using their smartphones and tablets more and more to upgrade to a larger allowance, while decreasing the price per Gb of data. But fierce competition makes it hard to escape a deflationary trend, particularly in markets where quality metrics do not appear to play a decisive role in differentiating operators.

– We thus saw operators turn to supplying content services, and applying zero rating, either through agreements with third party suppliers (Vodafone, T-Mobile) or with their own content (AT&T, Verizon). If the content is attractive enough, it can set an operator apart from the competition.

Some, however, see the zero rating trend as grounds for reviving the net neutrality debate. So what’s the problem? While it is clearly a good thing for consumers, the opponents of zero rating argue the following. If the service provider has paid the operator, we can expect to see a decline in diversity and innovation in the applications sector that benefits market heavyweights, which are able to finance their access to the market. If the service provider belongs to the operator (or is controlled by it), there can be discrimination if only that service benefits from zero rating. The problem is that there is a disagreement over whether these two suppositions are well founded, and require specific ex ante regulation, and especially whether they fall under the scope of net neutrality. The government of India forbade Facebook from offering a set of basic applications (including its social network) for free to the country’s mobile operators. Despite having been behind the Open Internet Order, which reclassifies ISPs as common carriers as defined by Title II of the Telecommunications Act, FCC Chairman Wheeler has been very circumspect about zero rating up to now, believing that the trend needs to be observed for a period of time before drawing any conclusions. Of course, the incoming Trump administration will shake up the FCC, and everyone expects the Open Internet Order to be challenged.