New IT-based technologies are coming to market with potential to disrupt media landscape

Most of them were developed in the IT world and were not specifically dedicated to video, books, music or video game industries. Among these disruptors, ‘artificial intelligence’ and ‘voice control’ are the major buzz words today, closely followed by the ‘blockchain’. The process of virtualisation of processes has already started in the media industries, such as VR and AR developments. Altogether, they are firmly expected to drive us towards a new ‘augmented media‘ experience.

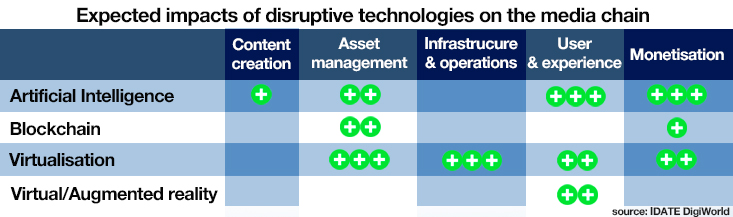

Positive externalities awaited for user experience and operational efficiency media industries

Enhancements for the consumer include a better and more immersive quality of experience, higher engagement with contents and artists, and more personal recommendations. The industry should also reap some benefits from new technologies through higher operational efficiency and better monetisation options, in particular through targeted advertising and micro payments.

Promises are many, but much remains to be done to go beyond test phases and initial developments to address the mass market.

There is still work to do on technologies to make them stable, future proof or even standardised in order to see their full benefit on the media markets. Deep learning has not yet concretised its full potential: more user-friendly solutions have to be developed in VR and AR markets – the use of blockchain in media is still in a test phase.

Internet giants reaping the benefits?

The growing role of social networks and new cognitive platforms in media consumption is visible in many iterations. The accelerating trends of the growing role of data in content discovery, recommendation and monetisation; the weakening position of the middleman in a shortened and more disintermediated media chain are all signs of this.

The Internet giants, currently pushing forcibly on the media segment, are the best placed to benefit from these new technologies. In so doing, they will threaten even more the media companies which cannot compete, alone on their own, today. Investments in innovation and a broad raft of large-scale partnerships will be key for media groups to stay in the game.

To delve deeper into this theme

Buy our last report: "Augmented Media"

More info