Q : What are the key trends today?

When considering the main region of FTTX deployment, Asia is the region with more FTTH sockets deployed. However, Europe has also evolved in terms of FTTH and FTTB. Certainly, in Europe FTTH is now more deployed than FTTB with an exception in the Eastern region, where FTTB has taken the lead. When talking about technology implemented in Europe, certainly GPON is gaining momentum every year over P2P Ethernet.

Q : What are the global leading providers of superfast access?

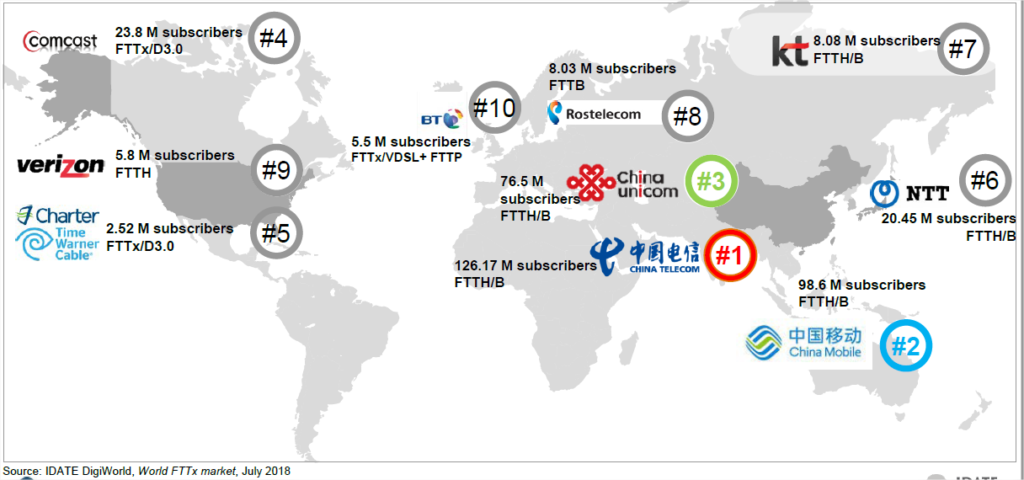

The global top 10 providers of FTTx access are distributed along different regions. We can identify 5 Asian players, 3 US players, one Russian player and one from Western Europe.

China’s three telcos (China Telecom, China Mobile and China Unicom) top the FTTH/B rankings. It’s worth noting the tremendous progression of China Mobile now N°2 worldwide.

Certainly, BT is the player from Western Europe who enters the ranking due to its large-scale FTTN+VDSL rollouts (BT). When talking about American players, it can be observed how two US cablecos as Comcast and Charter have now completed their infrastructures migration to FTTx/D3.0 and FTTx/D3.1. In addition the merge between Charter and Time Warner in USA, has taken European cableco Virgin Media out of the TOP 10 chart (5 million FTTx/D3.0 subs.).

Q : FTTx: how is Europe positioned against the USA and Asia?

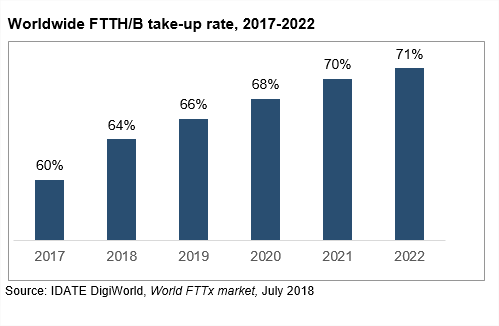

Europe is in the evolution towards the adoption of FTTx networks. Certainly, 35% of households in Europe has subscribed to an FTTx solution. Meanwhile this number is about 70% in the USA and more than 70% for the main APAC countries (Australia, Bangladesh, China, India, Japan, Kazakhstan, Malaysia, New Zealand, Philippines, Singapore, South Korea, Taiwan, Vietnam).

Therefore, there are many opportunities for Europe to deploy FTTx technology. In addition, thanks to the European “Digital Agenda”, more initiatives have arisen in order to achieve a throughput of 30 MB / s, for 100% of homes covered by the 2022 horizon. A great opportunity to boost the economy of all Europe.

Q : What are the forecasts in terms of FTTH / b subscribers for the next 5 years?

FTTH/B subscriptions should continue to increase at an annual average rate of around 13% until 2022. However, the growth rate in the total number of FTTH/B subscribers will gradually decrease from 20% in 2017 to 8% in 2022: this is linked to the gradual maturity of the markets.

According to IDATE, by 2022 the share of FTTH/B subscriptions will represent 49% of total broadband market worldwide (to be compared to 44% at end 2017). Certainly, FTTH/B is now deployed in all major regions in the world, at different levels: FTTH/B represents a great opportunity for emerging countries where broadband is not yet widespread (Latin America, Africa and some countries in south east Asia).

To find out more about the global FTTx market

Purchase our last market report (+ dataset)

More info