This latest IDATE report presents the state-of-the art of the small cell and Wifi opportunities to close the gap and highlights strategies at play. It also gives the flavour of future scenarios.

Wifi is not brand-new. It has been playing a key role in releasing network congestion for years because it is not expensive. Seamless connectivity and handover between cellular and Wifi are addressed carefully. Carrier Wifi solutions that promise an enhanced customer experience and security through Passpoint/Hotspot 2.0 are currently implemented by players. Wifi has also been widely adopted to provide voice services through Wifi calling, also known as VoWiFi.

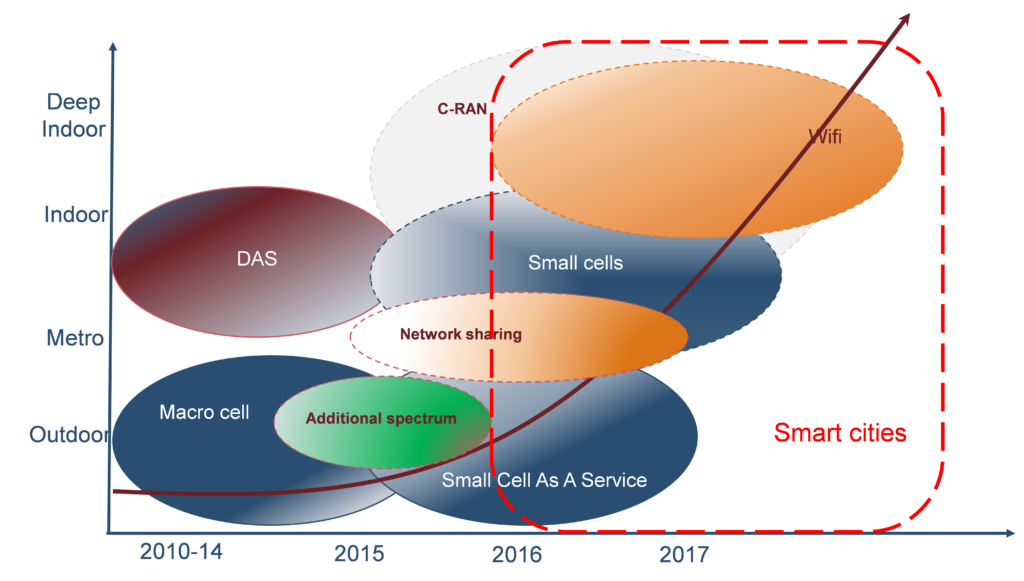

All in all, small cell and carrier Wifi are needed for a smooth transition to 5G, scheduled at the earliest for 2020. IDATE forecasts the small cell market is at last close to take-off. We foresee a huge growth of the small cell market driven by a robust increase in mobile data traffic:

- Macrocell densification continues in Europe as population coverage has not yet reached the 95-100% range.

- Alongside macro cells, MNOs are increasingly relying on carrier Wifi and small cells to cope with mobile data surge in cost-cautious times. Small cells have extended beyond the first devices dedicated to residential use and moved to urban, enterprise and rural areas. Technical innovations facilitate the management of small cell interference with the macro network. Small cells give the opportunity to come closer to the user and to increase customer experience. They can be installed in street furniture, for instance.

- In this face-off between cellular and Wifi, different players want to take a share of the cake.

Wifi-first players appeared in 2014 in the USA with a disruptive proposition: customers are using primarily free Wifi and they switch to paid cellular when Wifi is not available.

With Wifi, cablecos are on the road to offer quad-play services. Mobile is both an additive strategy to grow into a new market segment and a defensive strategy to cement cable’s stronghold in households.

OTTs were very successful in creating innovative services and in expanding them to many different devices. With a 20 USD plan, Google Fi is able to threaten MNOs in the USA and to attract young price-sensitive customers. Apple was very successful in eating into MNO revenues with popular iPhone services.

Small cells as a strategic path to the smart city

Small cells can use existing street furniture such as lamp posts, billboards or bus stops to come closer to the customers: JCDecaux pioneered the concept of subsidizing public street furniture in exchange for rights to advertise. Installation can also be done on municipality furniture such as lighting poles and traffic lights: Philips promotes actively the LED technology. Supporting digital lamp posts, it signed a partnership with Ericsson to integrate Ericsson’s small cell equipment in lamp posts.

Towards hyper density and emergence of smart cities

Find out more information on "Small cells and Wifi offloading"

in our dedicated market report

More infoTags