It is also a fragmented market, with more than half of the countries being home to fewer than 10 million people, which means very small markets. The phenomenon is further accentuated by the plethora of languages spoken, often within the same country. On the other end of the spectrum, the region’s biggest markets, which include Nigeria, Ethiopia and Egypt, have populations of more than 80 million (174 million for Nigeria).

Hugely disparate markets

Africa is home to a widely disparate telecom markets: some countries such as Eritrea, southern Sudan, DR Congo and the Central African Republic are suffering from severe unrest and have very low mobile density rates – which is measured in the number of SIM cards per capita – of below 50%. The most advanced countries are the Gulf states, some of which have even more mature markets than developed countries’. The most advanced countries in Africa are those located in the extreme north and extreme south, whereas most of those in central Africa are lagging behind, largely because of the many confl icts that continue to devastate the region.

Fast growing markets

Several countries are poised to enjoy an especially strong increase in mobile subscribers:

• Nigeria had a mobile penetration rate (number of SIM cards per capita) of only 83% in 2016, for a population of more than 186 million. Despite the decrease in oil prices, the number of SIM cards in use is forecast to increase by around 25 million by 2021.

• Mobile ownership is also very low in DR Congo where mobile adoption stands at 38% for a population of close 81 million. The number of SIM cards there is forecast to increase by more than 14 million by 2021.

• Lastly, mobile adoption in Ethiopia stands at a mere 48% amongst its population of more than 102 million. Poverty is dire in this country where GDP per capita stood at 590 EUR in 2016. The number of SIM cards in use is expected to increase by more than 32 million by 2021. These three countries together will represent a third of SIM card growth in Africa in the medium term.

Core sub-regional trends

Even if each sub-region often contains countries that are at different stages in their ICT development, we are nevertheless able to pinpoint certain major trends in each.

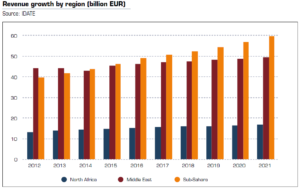

Gulf States driving the Middle Eastern market

On the whole, the Middle East is the most developed part of the region, thanks to the leadership of the Gulf States whose equipment and consumption levels are comparable to those found in developed countries, and where ARPU is high. Totalling 48 billion EUR in 2016, this part of the world accounts for close to half of the MEA region’s telecommunications market revenue – with Saudi Arabia, Iran and the United Arab Emirates as the region’s heavyweights – but home to “only” a quarter of the region’s mobile customers. This dichotomy between value and volume already exists on a more macroeconomic level: the sub-region accounts for 45% of the MEA region’s GDP, but is home to only 20% of its population. However, because these markets have reached maturity, growth is forecast to remain below 1.4% a year between now and 2021.

Steady growth in North Africa

North Africa’s ICT markets are well developed, particularly in countries such as Egypt, Morocco and Tunisia, all of which have implemented government-backed ICT support policies. Growth rates in the Maghreb region will remain steady: averaging 2.2% a year up to 2021.

Sub-Saharan Africa still a major source of future growth

Sub-Saharan Africa is dominated by South Africa, which accounts for 20% of the region’s telecom revenue and is very advanced in the area of ICT. But growth there is slowing automatically as the market is nearing maturity. Let us also cite Nigeria as the other ICT heavyweight in this sub-region.