In mid-2018, three indicators show how fast the eSports segment is growing:

- Investment in eSports in 2017 was the highest ever. There were about 100 transactions worth 1.8 billion USD.[1]

- The number of active professional or semi-professional players was 17,400 in 2017, compared with about 8,000 in 2014.[2]

- The yearly overall sum paid out in prize money to competitors amounted to 113 million USD in 2017,[3] more than 10 times higher than in 2011.

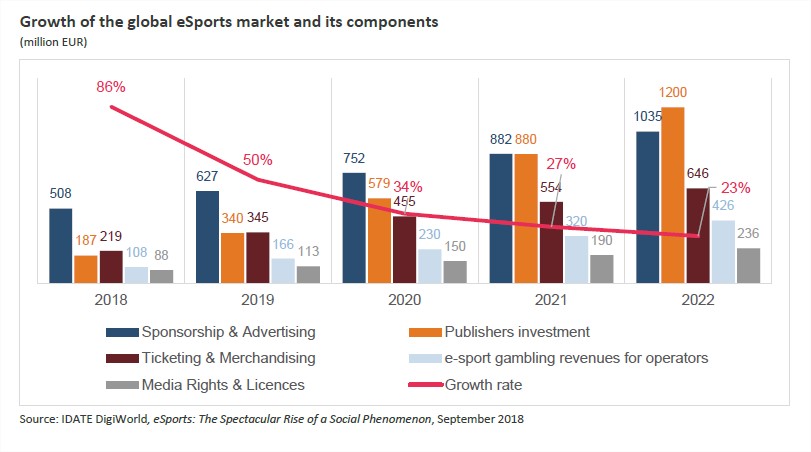

Regarded by Generations Y and Z as a pastime and sport in its own right, eSports is expected to generate 1.1 billion EUR in revenue by the end of 2018. By 2022, this figure could exceed 3 billion EUR. eSports only accounts for 1.2% of revenue generated by the video game sector. It is still a small sector, but one that is already attracting a large audience: 353 million people worldwide by late 2018, according to IDATE DigiWorld. The central question is therefore how to monetise this audience as best as possible.

There are a few trends observed in mid-2018 that highlight the challenges and future development of eSports.

To generate revenues, rights holders are adopting an integrated approach to organising competitions to varying degrees. Activision Blizzard, who publish Overwatch, has opted for an integrated model. The Overwatch League currently consists of 12 franchises created based on the US sports model. Owners paid about 20 million USD for each franchise. Six new franchises will be added this year. Investors will now need to pay up to 60 million USD to obtain one.

Some games are now “predesigned” to be played in eSports. The benefit lies mainly in prolonging the game’s life cycle, which increases from a few months to a few years, sometimes over 10 years. Fortnite, a third-person shooter developed by Epic Games, is one such example. After it became a resounding success (it has generated over 1 billion USD since launching in October 2017 to May 2018), the developer announced it plans to provide 100 million USD in prize pool money paid to competition players.

eSports is cultivating its communication strategy and recruiting famous sportspersons who are close to video game culture. Sport and eSports have also developed a closeness that many would call natural. US sports franchises and European football clubs were quick to grasp that eSports could have a positive effect on their activities.

The audience for this young discipline, mainly composed of Generations Y and Z, are not as wedded to stadiums as previous generations. Getting involved in structuring eSports within the clubs themselves is a way to connect with these younger consumers.

In a flourishing environment, the major eSports segments are taking up the challenge with the hope of capturing a share of the financial windfall it promises.

- Publishers and development studios are increasingly pursuing an industry strategy. Long regarded as a source of additional revenue, eSports now underpins the development strategy of video game publishers and studios. These players are positioning themselves along the eSports value chain or developing a partnership strategy with established service providers.

- Promoters and franchises are strengthening their position in the value chain. Having driven eSports growth for a long time, these players are being challenged by rights holders, mainly the publishers and developers, who want to (re)take control of exploiting their titles in the competition scene. Their technical and logistical expertise does ensure they remain indispensable stakeholders, even for publishers who want to internalise the eSports business.

- TV channels are trying to assess the phenomenon and to integrate it into their broadcast model. Sky, BBC, ITV, Fox, TBS – and especially Disney through ABC, ESPN and Disney XD – are now broadcasting eSports events. However, it is the Web players that are taking full advantage of eSports audiences, especially Twitch and YouTube Gaming, but also eSports specialists such as Electronic Sports League (ESL), Major League Gaming (MLG) and Smashcast.

- Betting companies are waiting for more favourable legislation. In May 2018, the United States Supreme Court decided to let each individual state create their own legislation for sports betting. This decision will impact eSports. It will allow it to generate revenues that should ensure it can grow at a sustained rate.

[1] Source: CBINSIGHTS, late October 2017

[2] Source: www.esportsearnings.com, July 2018

[3] Source: www.esportsearnings.com, July 2018

To delve deeper into this theme

Buy our last report DigiWorld Watch Service "E-sport: The spectacular rise of a social phenomenon"

More info