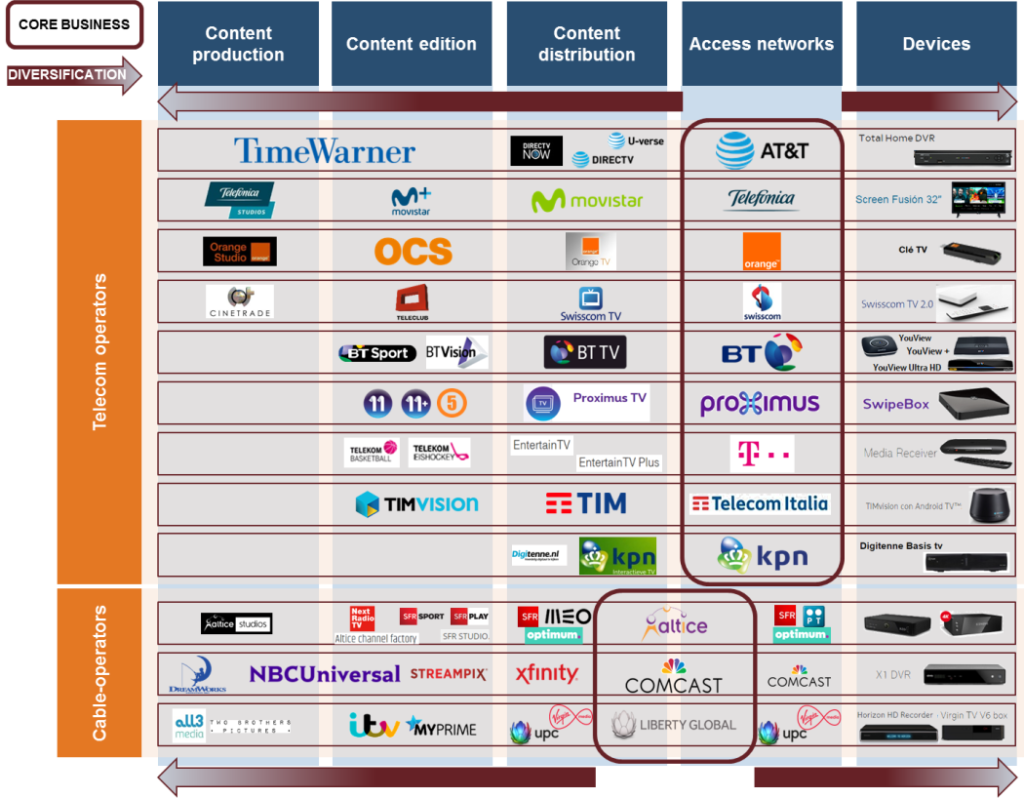

If the mergers between content and pipes at the start of the 21st century are still far from having proven efficient, the way telecom networks have evolved, the ubiquity of portable screens and the huge changes in users’ viewing habits have, among other things, created an environment that may now prove more welcome to various forms of integration or closer partnerships between content owners and network operators.

Owning content has become an imperative for telcos, especially as a way to shore up their core business:

- merely selling standalone fibre or 4G access is no longer enough: it only makes sense to boast to consumers about how fast and efficient their network is if its purpose is to deliver some named content. So content is becoming a major selling point that will allow telcos to attract internet subscribers;

- as price wars continue to rage between ISPs, developing TV/video services has become a way to rebuild ARPU and prevent margins from shrinking;

- owning exclusive content allows operator’s to boost their image with customers, and lessen the risk of being cut out of the loop by OTT vendors.

But there are still two lingering unknowns regarding the likelihood of future success for these new strategies:

- the position of competition authorities which could block or defang some of these mergers and partnerships;

- the position of internet giants which have both massive cash on hand and a global user base, which no telco today is able to rival.

Source: IDATE DigiWorld, Video content, April 2017

To delve deeper into this theme

Buy our report: Future TV & Video 2025

En savoir plusBuy our report: Video content - the new eldorado ?

En savoir plusBuy our report: World TV & Video market

En savoir plus