At the 10th annual Assises du Très Haut Debit (Superfast broadband symposium) hosted by Aromates and IDATE DigiWorld in Paris on 6 July, we delivered a sneak peak of our coverage figures for Europe at the end of 2015, drawing on our own FTTx databases, the latest data collected from regulators and operators, along with our freshly released market report, “The Digital Agenda for Europe: a snapshot”.

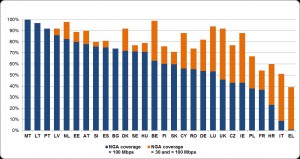

European superfast and ultrafast rankings: 30 and 100 Mbps NGA coverage (December 2015)

Clearly, the situation varies dramatically from country to country, and the objectives set by Europe will be hard for some countries to achieve without a major policy push. The most advanced countries benefit from a strong cable footprint and an incumbent carrier that has made less ambitious technical choices than extensive FTTH rollouts. Belgium, for instance, combines vast a and dense cable system that has been upgraded to the latest Docsis technologies (>100Mps) and the top carrier’s choice to upgrade its legacy copper network to VDSL (>30Mps).

On the whole, the largest countries in Europe are less likely to achieve all of the Digital Agenda objectives. In France, for instance, the combination of giving top priority to achieving extensive FTTH rollouts, the relatively limited cable coverage (40% of households) and the very gradual deployments in the country’s more rural areas based on public-private partnerships – which will eventually coverage 40% of access lines – have put the country among the lowest ranked in terms of availability of superfast access lines and average connection speeds. The situation is better in the UK and Germany where BT and DT were quick to deploy VDSL (>30 Mbps) access products, in response to aggressive competition from cablecos. Meanwhile Spain, which has combined investments in FTTH and cable, also tops France in the rankings. Only Italy, whose incumbent dragged its heels on significant spending on FTTH and was unable to capitalise on a cable system, is faring less well than France.

The IDATE DigiWorld report reveals that, once ultrafast access networks are in place, customers are eager to sign up. We have therefore noted a much higher NGA take-up rate in those areas where ultrafast access (100 Mbps and faster) is available. This means that we can count on a virtuous cycle of differentiation that encourages market players to invest in faster networks, not with a view to continually increasing the price of access plans, but rather to enable solutions that meet a growing array of needs.

When considering these future scenarios we must not, however, underestimate the complexity of the regulator’s task which, up until now, has been defined by European copper LLU rules. The fact of replacing ADSL with VDSL (with Vectoring/Bonding and G.fast) and FTTH would seem to give the incumbent a natural advantage, setting up a duopoly with cable. But this is too simplified a view since we also need to take into account (particularly when looking at the regulatory situation in France) the potential for duplicating superfast infrastructures in very high-density areas, how it is in operators’ interest to pool their investments in medium-density areas, and the role of public-private partnerships in sparsely populated areas, not to mention the promise of superfast mobile.

Hope you all have a great summer!