This report analyses cities’ spending on the smart city market. It details the scale of their projects, the percentage of (inter)communal budgets it represents, both overall and by “smart” area, along with growth trajectories.

It covers the EMEA region and includes case studies of 8 major metropolitan areas in the region: Paris – London – Antwerp – Wroclaw – Cape Town – Tel Aviv – Kigali – Dubaï

These close-up looks deliver a detailed snapshot of the city, its approach to building a smart city, and an exploration of two major smart city projects and how they align with key priorities relating to the segments and sub-segments analysed:

- Video-surveillance

- Smart parkings

- Smart lighting

- Public waste management

- Air quality monitoring

- Citizen Relationship Management (CRM)

The report provides market updates by major smart city area and projection up to 2024 and addresses the following questions:

- What are cities’ top priorities?

- How much value will the six identified key sub-segments generate?

- How has the current unprecedented global crisis affected these digital markets?

A bottom-up methodology is used in this report:

- Providing maps of the cities, populations and rural areas for each examined area

- A view of the size and breakdown of cities’ preliminary budgets

- An assessment of cities’ “smart” solution spending and priorities via case studies

- General conclusions and regional spending projections, detailing how demographic, technological, societal, political and current issue-related variables are being taken into consideration.

The 2020 version differs from the 2019 report by:

- A geographic scope now confined to Europe and Africa/the Middle East (EMEA)

- More detailed forecasts, supplementing the six major types of smart solution explored in 2019 with six key sub-segments whose market dynamics are examined more closely

- An examination of the global impact of COVID-19 which has forced a rethink of how this unprecedented crisis has increased reliance on digital tech as purveyor of “continuity” and potential savings

The dataset including the market estimates is delivered with the report.

During this unprecedented crisis, where social spending will weigh heavily in local authorities’ budgets, digital tech nevertheless remains a protected segment, thanks to (inter)national recovery plans. Cities’ overall spending on smart city solutions is likely to be maintained, if not increased, to reach 90 billion $ in 2024 worldwide.

Key figures :

- During this unprecedented crisis, where social spending will weigh heavily in local authorities’ budgets, digital tech nevertheless remains a protected segment, thanks to (inter)national recovery plans. Cities’ overall spending on smart city solutions is likely to be maintained, if not increased, to reach 90 billion $ in 2024 worldwide.

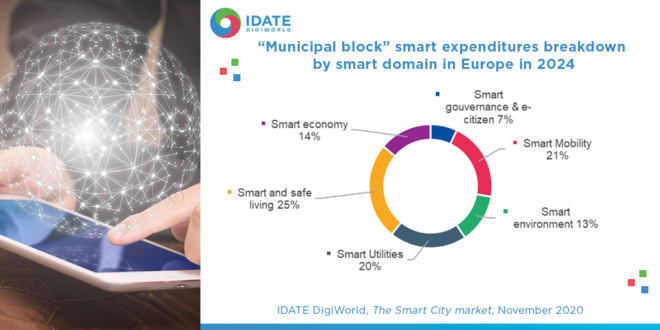

- Green transition and digital transition: strengthening a responsible tech approach that should give smart utilities and smart environment initiatives a boost, which will grow from 6% of city spending on Smart Cities in 2020 to 13% in 2024.

The Smart City Market

Access the study

The Smart City Market