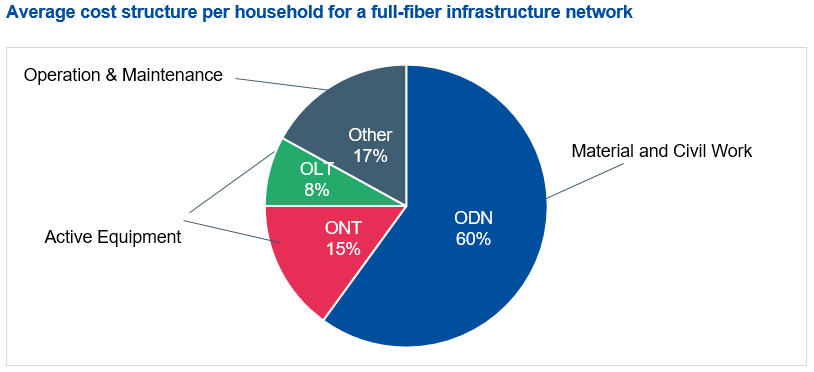

The Optical Distribution Network (ODN) is a key segment of fiber-based networks, connecting the central office and terminal user. Its design, construction process and operational management features are strategic for operators: costs associated to the ODN represent about 60% of the total cost needed for connecting a household to an FTTx network, and the ODN needs to be easy to expand in order to cover new households in the long run.

Difficulties in ODN resources management are also long-standing issues pointed out by telcos, which can lead to power outages on the network and make the connection of new premises more difficult. This causes carriers’ OPEX to increase. Inaccurate ODN resources greatly increase carriers’ investment in number allocation and ODN troubleshooting, resulting in invalid capacity expansion and resource audit. It is therefore paramount for telecommunications operators to optimize ODN equipment features and internal resource use, especially in a context where highly skilled workforce is required but often lacking. Besides, FTTx deployments currently under way and the modernization of older networks generates a strong need for ODN products that should translate into a strong upwards market trend in the next five years.

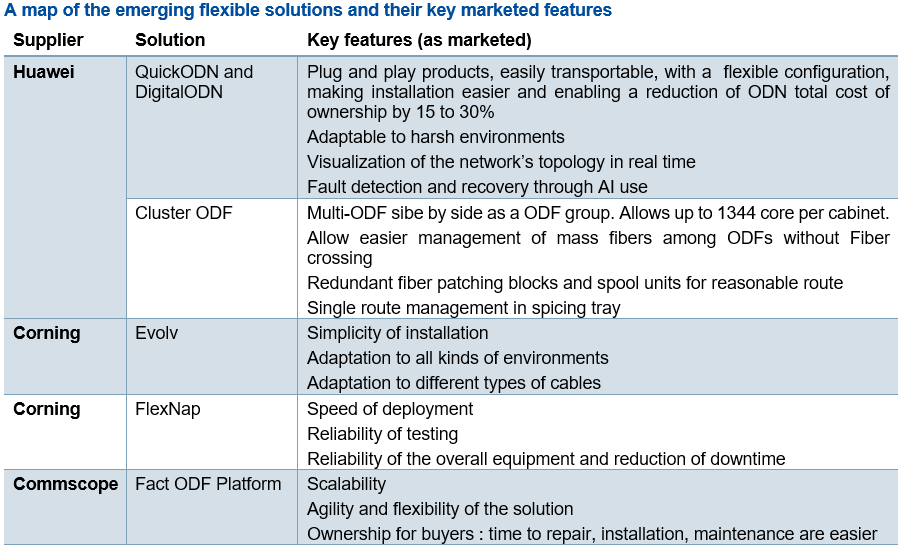

As a response to this increasing demand, main players on the ODN equipment market have deployed innovations both in their products’ technical features and in their positioning on the FTTx value chain. On one hand, plug-and-play ODN products are becoming increasingly popular, as they make the ODN construction process simpler and less demanding in terms of labor. AI is also emerging as a key to improve fiber networks development, operations and monitoring at different levels. Leveraging machine learning, AI can help diagnose faults in the network, based on past faults or similar network experiences.

ODN vendors are also taking into account future network expansion and customer handoffs between operators on the wholesale market when designing their products’ features. At the same time, equipment manufacturers are introducing high value-added services to their portfolio, which enable quicker and more efficient deployments. ODN manufacturers are historically located at the construction stage of the FTTx value chain, as providers of solutions for passive and optoelectronic equipment. Over the past few years, they have increasingly been expanding their portfolio of services upwards, towards architecture design advice, and downwards, towards operational support. In certain cases, ODN solution providers take over as the main technical player, whereas telecommunications operators focus on the commercial and value-added connectivity side.

ODN vendors have therefore shifted from an offer of off-the-shelf products to customized turnkey solutions including design and operation services, hence expanding their presence in the FTTx value chain. From a market perspective, few players currently on the ODN product segment have the critical size and resources needed to provide such turnkey solutions, hence hinting towards greater concentration of the market in the future, at least in geographical areas where FTTx network deployments remain in the early stages. The main players currently offering ODN integrated solutions are US-based companies Corning and Commscope, China-based Huawei, and Japan-based Fujikura.

Based on our analysis, we can segment the ODN supply market along two dimensions:

- First, the ability to offer most of the ODN equipment required by a telecom operator vs.be a niche player with a limited number of equipment.

- Second, the level of innovation offered and value-added services allowing telecommunications operators to better control their deployment costs

Based on these two dimensions, we can define a positioning of the ODN equipment manufacturers. Our analysis makes it possible to identify the respective positioning of the equipment manufacturers. It also highlights the players highlighting the most comprehensive and innovative offer.

Innovation in technology and services linked with a strong demand from telecommunications operators to deploy fiber networks will sustain an important growth on the ODN equipment market, which will grow at a compound annual growth rate of 10.9% between 2020 and 2024, reaching a total market value of USD 4.3 billion. The Asia-Pacific and Middle East-Africa regions will be particularly dynamic thanks to strong demand from telecommunications operators: it should grow from a combined 38% to 63% of the world ODN equipment market in value between 2020 and 2024.

Access the White Paper

Optical Distribution Network (ODN)