Four development scenarios: from disruption to syndication

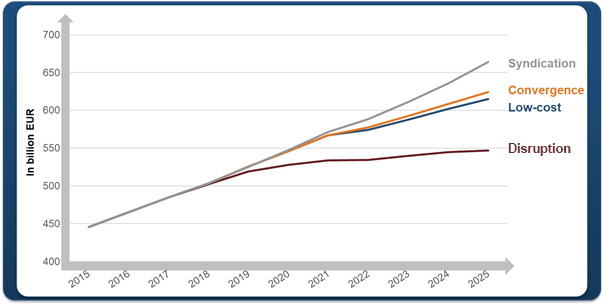

By combining the underlying trends and weak signals we are seeing in the markets, we have mapped out four possible scenarios for the future TV industry, ranging from a conservative scenario carried by a perpetuation of the current low-cost trend, to the riskiest scenario marked by a veritable disruption, by way of two middle-paths scenarios: one driven by the syndication of veteran industry players, and an alternative scenario of telecoms-media convergence.

Each of these scenarios translates into more or less positive growth trajectories for the different types of player in the new television ecosystem. The “Disruption” scenario is the most detrimental to the TV sector, and the only one where television revenue will decrease between 2016 and 2025 (average annual decrease of -0.9% during that period). Under this scenario, internet companies gain real traction as on-demand viewing quickly wins out over linear TV, which itself is losing ground at an accelerated pace.

At the other extreme, the “Syndication” scenario is the most positive for the sector as a whole, (average annual growth of 4% between 2016 and 2025), and the one wherein all of the major TV companies regain the upper hand, and see their brands triumph over industry newcomers.

The future of TV in four scenarios, 2015-2025

Global TV market revenue (TV, DVD, OTT)

Different future in each country, due to disparate TV ecosystems

Because of the marked differences we find in the different national TV markets, as much in terms of screen time as how the different types of player are positioned, or the regulation in effect, we expect to see the situation in each country evolve in different ways:

- The United States could move quickly into a “Disruption” scenario, driven by the swift rise in OTT viewing in the country, the fact that all of the top internet companies are American, the very high ownership levels for connected devices and very high broadband access take-up.

- France could be one of the countries that evolves towards a “Convergence” scenario, given the exceptionally high rate of IPTV subscription and top telcos’ desire to offer, at the very least, a large selection of entertainment products (TV/video, print media, music), and for some to expand their footprint higher up the media value chain.

- The UK could shift towards a “Syndication” scenario, initiated by all of the top TV market players’ involvement in the Freeview platform, and facilitated by these companies’ ability to produce exportable content that could serve as a foundation for international collaborations.

- Lastly, Germany – a country were free public and commercial TV still dominate, but where cable has historically played an important role and OTT is rapidly gaining ground – could continue on its current path, and be a prime candidate for our “Low cost”

A bright future for content production across the board

Also for the first time, this year’s edition provides an estimate of how total market value will be broken down in 2016 and 2025 between the value chain’s three main components: production, operation and distribution. Figures are provided for the United States, France, the UK and Germany for both the “Low cost” and “Disruption” scenarios.

The production segment appears to be the big winner in the future TV landscape, with spending on production higher in all cases in 2025 than in 2016, thanks to growth being driven by OTT services.

Europe and the United States nevertheless differ in one respect: the “Low cost” scenario is overall more positive for content production than the “Disruption” scenario, with the content it creates enjoying wider international distribution on the top global SVOD services.

To delve deeper into this theme

Buy our report: "Future TV"

More info