“If last year entrenched the 4th Industrial Revolution with the ubiquity of deep tech (Internet of Things, the cloud, artificial intelligence, robotics and more) in every manufacturing and economic sector, the byword for the 2017 edition was ‘inclusion’. For we who are immersed in the DigiWorld, it is our duty to be aware of all those who may be left by the wayside of this digital revolution, and to prevent a digital divide at all costs. This revolution is inexorable and must be a source of hope, growth and job creation. It must be defended and explained.” Says François Barrault, Chairman of IDATE DigiWorld.

Every year we pinpoint what we believe are the most significant trends and events from amongst the constant, tumultuous stream of dispatches from the digital world, on the occasion of the future oriented debate DigiWorld Future.

This year, we had the honor of hosting prestigious speakers who shared their vision of the digital economy future and commented on the scenarios and conclusions presented in the DigiWorld Yearbook.

Video Report DigiWorld Future 2017

Speakers from this edition

News & highlights from this edition

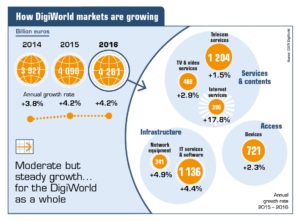

First, the overall rate of growth for digital markets as a whole is very stable. Holding steady at around four percent for the past three years. But that’s still one point less than GDP growth. Which explains why so many markets are feeling the pressure.

- One of these markets is infrastructure: but there is also some good news here! Thanks to the ongoing heavy investments being made by telcos and other major corporations, which together represent thirty five percent of the market. Operators have increased their spending on network equipment by more than five percent a year since 2010. And have even begun seeing a return on their investments in wireline networks. We are also seeing a slight acceleration for IT services, thanks to vertical applications, the switch to SaaS and the cloud, and the growing prominence of new applications such as Artificial Intelligence.

- Over in service and content markets: things were a bit sunnier for telecom services in 2016 – after five very glum years. Especially in Europe. Mobile services were finally reporting positive growth, after five straight years of losses. But it is OTT services (advertising for search or social networks, cloud, ecommerce, mobile apps, video…) that are still the market’s rocket fuel – turning in another very solid performance last year, with eighteen percent growth. At this rate, they will soon account for ten percent of the total market – which was already the case in Europe last year.

- The bad news comes from devices and the mere two percent increase in sales. Which is well below the impressive growth rates of the past. Smartphone sales appear to be reaching a plateau: it is only thanks to stronger mid-range handset sales that market value is still on an upwards trajectory. PC sales have been dropping for several years. And tablet sales have taken a brutal dive. TV sales are also down. But we do expect to see an upswing as consumers trade up to new ultra high-definition sets.

Regional dynamics have experienced various ups and downs since our last edition, but there is no doubt about the acceleration of growth in emerging countries, whereas the most advanced economies recorded only a slight improvement.

- The US juggernaut is losing steam. Aside from OTT services, every other market in the US is down. Television because of the sharp drop in pay-TV revenue, cord-cutting and the switch to bundled services. Devices too have experienced a dramatic drop in sales. And even telecom services have been on a downwards slide for two years due to increased competition.

- At the same time, China has entered a new stage in its development. Posting only three percent growth in 2016, compared to GDP growth of over seven percent. Is this proof that China is no longer really an “emerging” economy?

- The good news is coming from Europe whose recovery is holding steady. The EU enjoyed three percent growth last year, so almost equal to what we saw North America. If that may seem like a tiny number, let’s remember that we are coming back from zero percent growth in 2013. But we have not yet managed to make up for lost time, which has created an historic shift. Europe dropped to below twenty five percent (a mere quarter) of the global market last year.

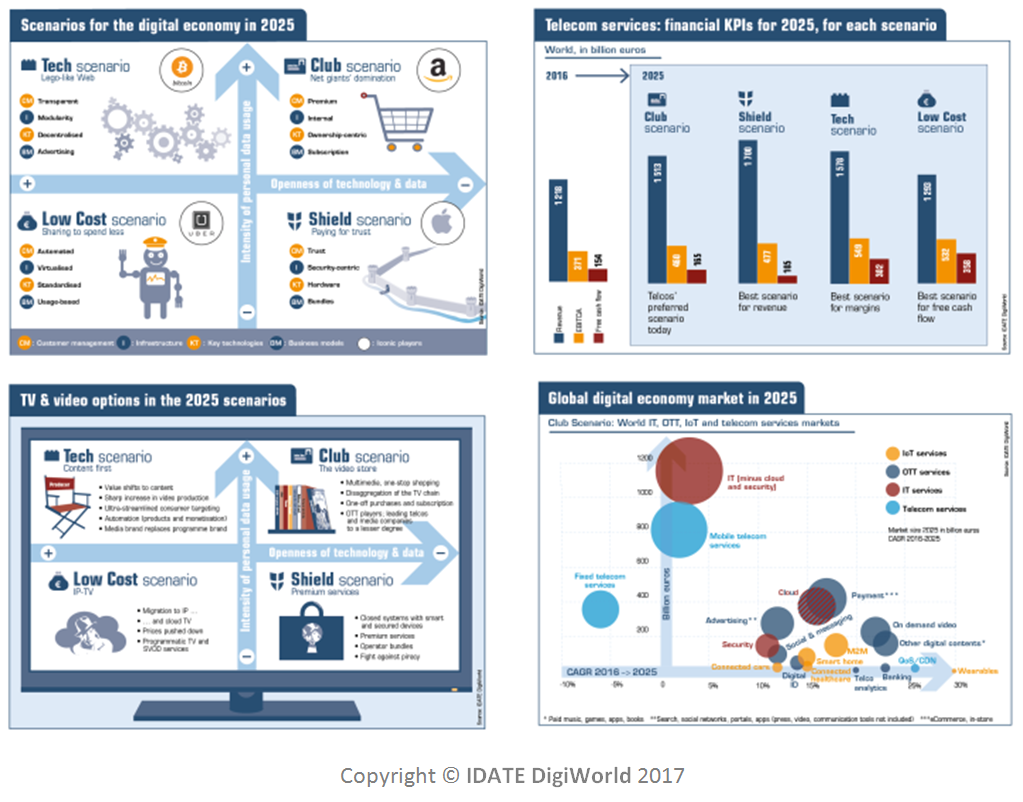

Digital economy scenarios for 2025

IDATE DigiWorld identified new value chains and news scenarios for the digital economy in 2025. “We have built four different scenarios involving reconfigured value chains: a ‘Club’ scenario of premium customer service; a ‘Tech’ scenario of modular leading edge technologies; a ‘Low cost’ scenario of a mandatory acquiescence to cost-cutting, and a ‘Shield’ scenario involving a highly secured cocoon.” Describes Vincent Bonneau, Head of IDATE DigiWorld’s Innovation Unit

What is the DigiWorld Yearbook?

A round-up of the finest analysis from IDATE DigiWorld experts who track global telecom, internet and media market developments year-round.

The DigiWorld Yearbook is published in English and French, and is available in print and PDF versions.

This edition is now available: Print: €100 excl. VAT – PDF: €65 excl. VAT

The 2017 edition is now available!

Order your copy

More info