With global penetration more than 100% in 2014, subscriber growth is expected to gradually slow down over the next few years. The number of fixed Internet subscribers is increasing at roughly the same pace, but customer numbers are eight times smaller. The one billion mark is not expected to be reached before 2020 and traditional landlines continue to loose ground as VoIP and mobile gain ground.

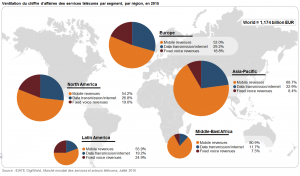

Breakdown of turnover of telecom services in the world, by segment, by region, in 2015

The spread of broadband

the number of fixed broadband subscribers is expected to reach 1 billion worldwide by the end of 2019. The number of LTE customers is shooting up, with services based on carrier aggregation no longer being limited to just the more developed countries.

Three major factors will play in favour of the spread of broadband:

- The success of bundled offers (fixed telephony, VoIP, TV, mobile telephony) and the appetite for video applications.

- The investment of telecom operators in the migration of their infrastructures to mobile or fixed broadband.

- The comfort provided by ultra-fast mobile broadband and the new uses it enables.

Revenue from telecom services

The global revenues from telecom services will grow from 1,174 billion EUR in 2015 to 1,293 billion EUR in 2020, representing an average annual growth of 2.0%.

- Revenues from mobile services will grow by 14% between 2015 and 2020 (+2.8% per year on average), reaching 814 billion EUR in 2020.

- Revenues associated with data transmission and Internet will grow more strongly (+21% between 2015 and 2020, i.e. +4.3% per year on average), to reach 344 billion EUR in 2020.

- Revenues from fixed telephony will continue to decline significantly (-23% between 2015 and 2020, i.e. a decline of 4.6% per year on average), to be at 135 billion EUR in 2020..

Disparate performances from operators in emerging countries

Top telcos in emerging countries continue to suffer from a sudden halt in value growth. China’s three operators in particular have seen virtually no progress: China Unicom actually reported a 3% drop in revenue. Their margins are come in line with industry standards: between 30% and 40% of EBITDA margins.

Several of these operators are actively engaged in an international expansion into Africa and Latin America, but also into advanced markets, particularly in Europe.

European operators starting incrementally to get back on track

Telcos in Europe are back on a growth path. If most of the top carriers are still reporting decreasing revenue, some are seeing an increase, notably Deutsche Telekom, Telenor and to a lesser extent Orange, thanks to their international operations. Their spending on LTE and superfast fixed access networks (FTTx) has not yet paid off and helped to bolster ARPU.

Discover the perspectives, key trends, and scenarios about the telecoms market for the next decade

Our last report

More info