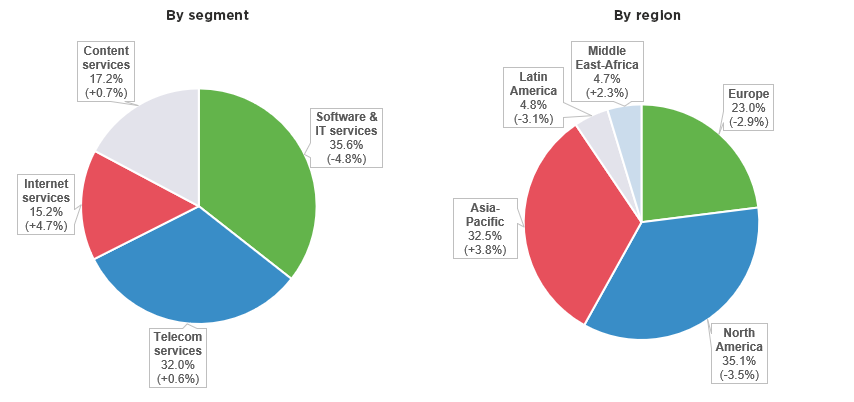

With a total value of 3,630 billion euros in 2020, the world’s digital services market1 saw its growth rate drop by more than 6 points: down to -0.8% instead of +5.4% hoped for in pre-Covid forecasts.

Despite which, digital industry sectors were not all affected to the same degree by the pandemic.

Telecom services markets have held their own, by and large, even if growth remains very meagre (+0.6 %, up to 1,161 billion euros in 2020). There have been two distinct trends at work: on the one hand, a sustained – if not improved – momentum in consumer markets and, on the other, slight pressure on business markets. On the consumer side, the surge in telecommuting in most parts of the world, combined with an increased desire for entertainment services boosted demand for both access and capacity, whereas businesses naturally attempted to temper the impact of the crisis on their bottom line by cutting their spending as much as possible.

This same cost-cutting drive amongst businesses has had a more dramatic effect on software and IT services markets (-4.8 % in 2020 compared to the +7.2 % expected pre-COVID). Meanwhile, as with telecom services, content services – both audiovisual (+0.7 %) and Internet (+4.7 %) – are experiencing more nuanced effects, and in different ways. Revenue from subscription services has been relatively unscathed, and in some cases benefitted from the crisis. This is true of video games, which have been very popular with consumers with more time on their hands due to lockdowns and, more broadly, to mandated restrictions on movement. E-commerce too enjoyed a veritable boom (+22.6 %) while, on the other end of the spectrum, ad revenue has felt the squeeze, as advertisers are being more careful than ever about their spending.

We have also seen geographical variations, which are due in part to digital markets’ maturity in the different regions, but also to the decisions governments have taken to handle the pandemic. Two markets have emerged relatively untouched. Africa, where more than half of digital services revenue still comes from telecommunications, remained on a growth trajectory: the Africa/Middle East region as a whole reported +2.3 % growth, which is “only” 3 points below pre-COVID forecasts. The other is Asia-Pacific, which benefitted from the Chinese economy’s recovery starting in summer 2020, but was also able to sustain quite a healthy growth rate (+3.8 %) overall.

It nevertheless remains that there is still a great deal of uncertainty surrounding the end of the crisis. In regions that have been spared thus far, and in Africa in particular, the pandemic has appeared to be spreading in recent weeks. In the rest of the world, the impact of the variants that have emerged over the past few months is still hard to predict: both directly from a health standpoint, and even more so indirectly on economies in general, and digital markets in particular.

After having published two reports measuring the impact of COVID-19 on audiovisual markets, and on the telecoms and Internet markets2 in autumn 2020, over the course of 2021 IDATE DigiWorld will continue to track the trends and changing market forecasts as the crisis continues to unfold.

Breakdown of the global digital services market in 2020

N.B.: 2019-2020 growth in brackets

Source: IDATE DigiWorld

1Digital services encompass four segments: IT and software services, telecommunications services, internet services and audiovisual services.