In both fixed and mobile access markets, the trend is one of increasing speeds, and especially the transition to superfast access (>30 Mbps) thanks to NGA network rollouts. But each is progressing at its own pace.

In the mobile sector, LTE rollouts are progressing rapidly, and subscription rates in Western countries are already high. It is safe to say that 80% of residents in Japan, South Korea, North America and the biggest European markets will be covered by LTE networks by the start of 2016, as will roughly 60% of the people in China. In addition to rapidly reaching 90+% coverage in the most advanced markets, LTE will steadily enable increasingly fast connection speeds: in excess of 30 Mbps thanks to frequency aggregation, more base stations in urban areas and the use of small cells combined with wide channels in high frequency bands. Starting in 2020, these developments will fold into 5G rollouts which are expected to deliver Gigabit-class datarates.

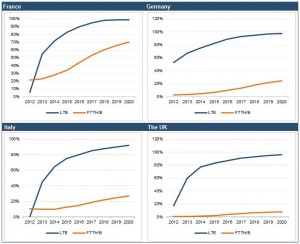

A comparison of fixed and mobile coverage in some of Europe’s largest markets (30 Mbps in LTE and FTTH/B), 2012-2020

Progress is slower in increasing fixed network coverage rates. It is also more complicated since it involves a mix of technologies that is specific to each national market. Schematically speaking:

- VDSL technology, which uses the legacy copper network’s local loop at least partially, makes it possible to achieve speeds of >30 Mbps, and even in excess of 50 Mbps, thanks in particular to developments such as vectoring and bonding;

- DOCSIS technologies, for cable companies that reuse the last mile of TV broadcasting networks’ coaxial cable. The vast majority of them are already selling plans with a speed of more than 100 Mbps and Gigabit-speed plans are soon to follow;

- FTTH technology which requires massive investments and a good deal of time to deploy fibre to customer premises. These systems deliver a headline speed of 100 Mbps and will be upgraded steadily to Gigabit-speed access.

In advanced markets, fixed and mobile NGA rollouts will go hand in hand, even if preliminary observations and forecasts give superfast mobile a slight edge in terms of pace. The current situation is giving rise to fixed-mobile convergence strategies, which are clearly illustrated in Europe through the recent spate of merger and acquisition deals.

The impetus behind the convergence trend can be found in the resulting advantages:

bundles and cross-selling synergies in customer accounts, online and brick-and-mortar shops, applications and video content;

integrated approach to fixed and mobile infrastructure: sharing backboning, though Wi-Fi which is now an effective bridge between fixed and mobile and, more and more, the savings generated on backhauling with the increasing use of small cells in densely populated areas, and through sharing SDN/NFV software infrastructures. Eventually, mobile services will represent a significant percentage of fixed network revenue, while the latter will provide short-range wireless access.

The countries where fixed-mobile convergence is the furthest along are Spain and France, where more than 40% of subscribers use the same operator for their fixed and mobile services. But there is also a general trend in Europe of markets being gradually structured around integrated fixed-mobile operators, as the result of an ongoing series of mergers and acquisitions.

The trend is less prevalent in the United States due to the fragmentation of wireline telcos, cable companies and mobile operators which often have only regional or local footprints. But US cable companies are investing in Wi-Fi and showing an interest in mobile services (Comcast) while AT&T, by taking control of DirecTV, is integrating fixed and mobile products at the national level.

As a small percentage of areas in advanced countries will probably still remain uncovered by operators’ FTTH/B networks in 2020, wireless access and especially LTE will likely be sold as a substitute, alongside satellite access plans and in some instances with hybrid LTE/DSL routers. This configuration is already being tested by several operators in the United States and in Europe. Added to this is the swath of customers in urban areas who have only a mobile subscription, even for their Internet access. The availability of additional spectrum resources, and notably in the 700 MHz band, often attached to obligations to cover more sparsely populated areas, should also facilitate this approach.

In emerging economies and especially in Africa, Internet access – which today is still confined to a fraction of the population – will be delivered primarily through the expansion of 3G and the deployment of LTE networks. But the needs of businesses and city demographics will progressively generate investments in wireline fibre networks, and set off a fixed-mobile convergence trend.

Find out more on Fixed-Mobile Converges and the latest trends and figures for LTE and FTTx

in our last report

More info