Interview of Roland Montagne by Jean-Dominique Seval.

Q: Where does Europe stand with superfast access?

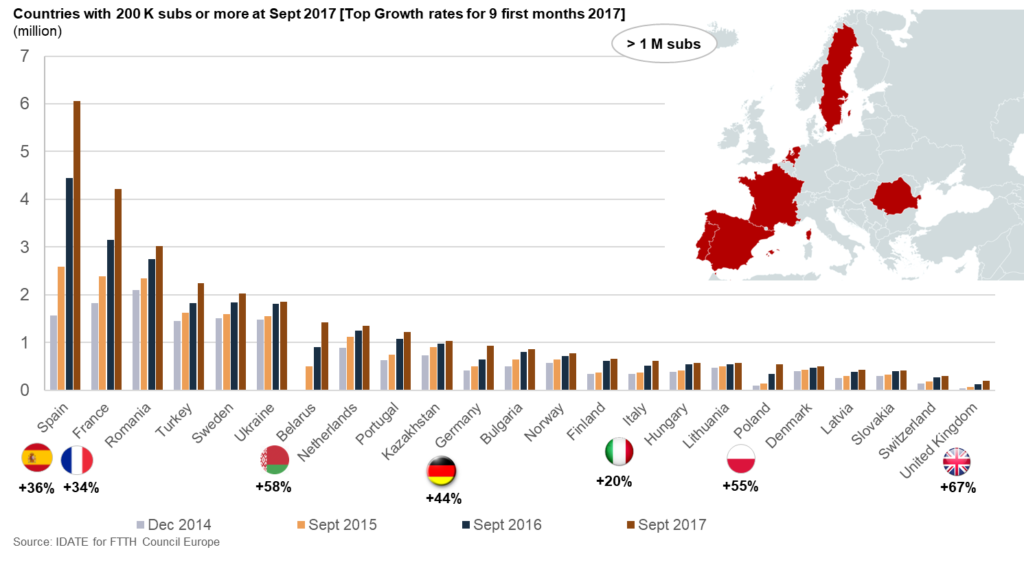

The good news is two straight years of increase for both subscriber numbers and homes passed. There were already close to 52 million subscribers for 148 million homes passed at the end of September 2017. The increase is especially notable when looking at subscriber numbers: +16.6% in a single year, while the number of homes passed grew by 7% during that time. This proves that operators are focusing more on marketing FTTH access products than on rollouts in some countries.

There are close to 100 million households in Europe that are now eligible to subscribe to a superfast plan, and that need to be won over.

As is often the case in Europe, this acceleration in the rate of adoption in all of the countries being examined hides huge disparities. Looking only at FTTH/B access, several groups can be distinguished among the leading countries:

- Russia and the Baltic countries lead the way by a comfortable margin, with more than 90% of the population covered, thanks in large part to the swift adoption of fibre, due to the absence of a powerful legacy copper network.

- Pioneer markets in northern Europe had already reached these coverage rates several years ago.

- Spain and Portugal stand out for the pace at which they have been moving ahead, and now reporting coverage of 88% and 98%, respectively.

I should also point out that France is also catching up quickly, with subscriber numbers growing by 34% in 2017.

European overall ranking: FTTH/B subscribers

Q: What are the main trends we are seeing at the start of this year?

There are several especially salient points that allow us to identify key trends for the coming years.

Europe still has tremendous growth potential

Several large European countries are still in the adoption stage, but things are moving fast.

- We are seeing a real push in Germany, notably through certain cities and players such as Deutsche Glasfaser. Also worth noting is the national “Gigabit for Germany” scheme.

- In the UK – which also lags behind because of the choice to rely on VDSL copper solutions before moving to fibre – several players plan on seizing this window of opportunity to develop their business, including CityFiber and Gigaclear, which won an FTTH Council Europe Award for 2018.

- France is clearly in midstream, with still very ambitious targets to meet.

- Italy, which enjoyed a solid lead for a time thanks to pioneering investments from FastWeb, plans on making up for lost time, as demonstrated by the success of the Open Fiber plan by national energy company, Enel, which had deployed more than 2.5 million sockets as of January 2018.

5G providing newfound impetus to the fibre market

The roadmap for 5G has once again been moved forward, with the first commercial launches announced in Asia, but also in the United States, for late this year. Telcos that have been pioneers on the fibre front will enjoy a competitive edge when the many antennae required to bring 5G coverage to the regions will need to be connected to the fibre network.

Verizon, for instance, plans on upgrading its superfast network by deploying the fibre that, in theory, is meant to ensure that its future 5G network will run smoothly, as evidenced by the 1 billion USD contract signed with Corning (and Prysmian) in September 2017.

Optical fibre producers under pressure

This is a lesser known fact, but one that is worth underscoring. The massive demand for fibre for FTTH/B networks coming from Asia and North America is raising concerns about a possible breakdown in the supply of fibre for operators that are currently in full rollout mode.

The fact that demand coming from Europe is spread out over time will allow the region’s operators not to suffer too much from this potential shortage.

Also worth mentioning here is that one of the global leaders in this area, alongside Corning, Prysmian and Furukawa, is Chinese cable layer, YOFC (pour Yangtze Optical Fibre), which is benefitting from the tremendous push by Chinese telcos.

Q: How would you describe Europe’s singular place in the superfast access universe?

As we have seen, Europe occupies a singular place in the global superfast access market. Our forecasts (obtained through out database on the global superfast access market) reveal a global market that will reach 674 million FTTH/B subscribers, compared to 469 million in 2017.

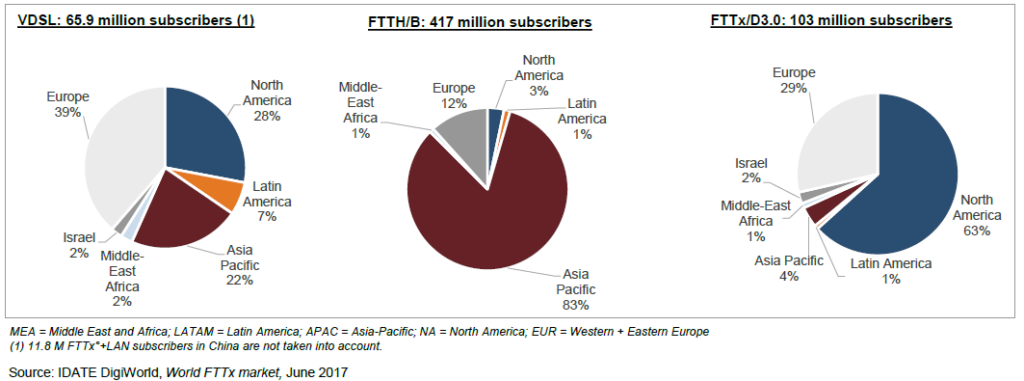

The challenge for Europe is to stay the course, to be able to have an infrastructure capable of undergirding the massive development of digital applications in the coming years. This will be achieved by also taking into account Europe’s diversity which, if it only represents 12% of the world’s FTTH/B subscribers today, leads the way in total subscriber numbers thanks to VDSL technology (39% of the global total) and a very solid 29% share of the world’s superfast cable subscribers.

So I remain confident about Europe’s ability to ensure that those key countries that currently lag behind will catch up, by making the necessary investments and reorganising the strategic landscape.

Geographical breakdown of the three main superfast broadband architectures

To delve deeper into this theme and get more information about the Ultra Fast Broadband market and players by region

Buy our last report "World FTTx Market"

More infoTags