The start of the games market will be slow

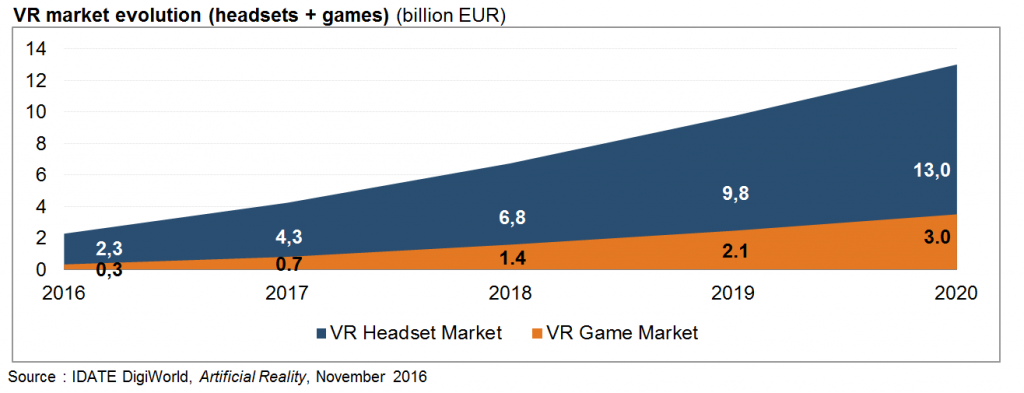

The low valuation of the games software market (just games for fixed or mobile all-in-one headsets) is explained by relatively low prices, which reflect the experiences offered: often short, with relatively underdeveloped narration, environments, interactions, etc. However, we are starting to see a catalogue of high-end games emerge as developers want to invest as quickly as possible in the new market opened up by the Oculus Rift, HTC Vive and Playstation VR. Most publishers able to offer AAA experiences are waiting for the headset installed base to be large enough to amortise the several million EUR investment needed for content creation. The price of headsets, around 600 EUR on average in 2016, explains the high valuation of the equipment market. These prices also explain why the headset sales volumes estimated by IDATE DigiWorld are below the forecasts made by its competitors.

Nearly 7,4 million VR headsets will be sold worldwide between now and the end of 2017

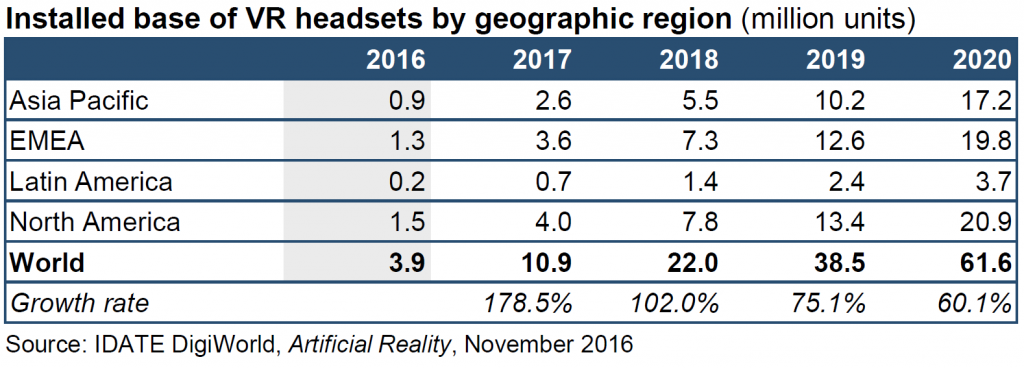

The majority of VR content experiences are currently deployed on smartphones In facts, 62% of revenues from this emerging market are generated on these mobile devices. Although the interactive or passive experience on smartphones is remarkable, it is usually mind-blowing when using a wired headset. This is why VR on fixed devices will gradually predominate in market value by 2020. Many headsets are already available on the market, but 2016 is the year when the expected major players arrive, such as HTC, Oculus and Sony. By the end of 2016, 3.9 million headsets will have been bought worldwide. For comparison, almost twice as many Xbox One units were sold in 2014, and three times more PS4 units in the same year. IDATE DigiWorld considers that the first generation of VR headsets will not be as successful as the hype would suggest. Overall, sales are likely to be lower than most observer estimates. The initial price for this technology is a key factor behind this caution.

An installed base of over 60 million headsets worldwide by 2020

By the end of 2020, North America and EMEA (Europe / Africa / Middle East) will each have about 20 million equipped households. This year, 15.8% of US households will have a virtual reality headset. Based on its historical tendency for purchasing high-tech goods, especially digital entertainment devices such as home consoles, the United Kingdom could post a penetration rate of 11.7%, followed by Japan with a penetration rate of 10.2%.

Tags